14.06.2019 - Studies

Since the aftermath of the Great Financial Crisis, market participants and rating agencies have generously assessed the quality of French public debt, especially compared to Italy. However, some French fundamentals have worsened, bringing France more in line with Italy. Accordingly, some convergence between the French and Italian government bond yields may be justified.

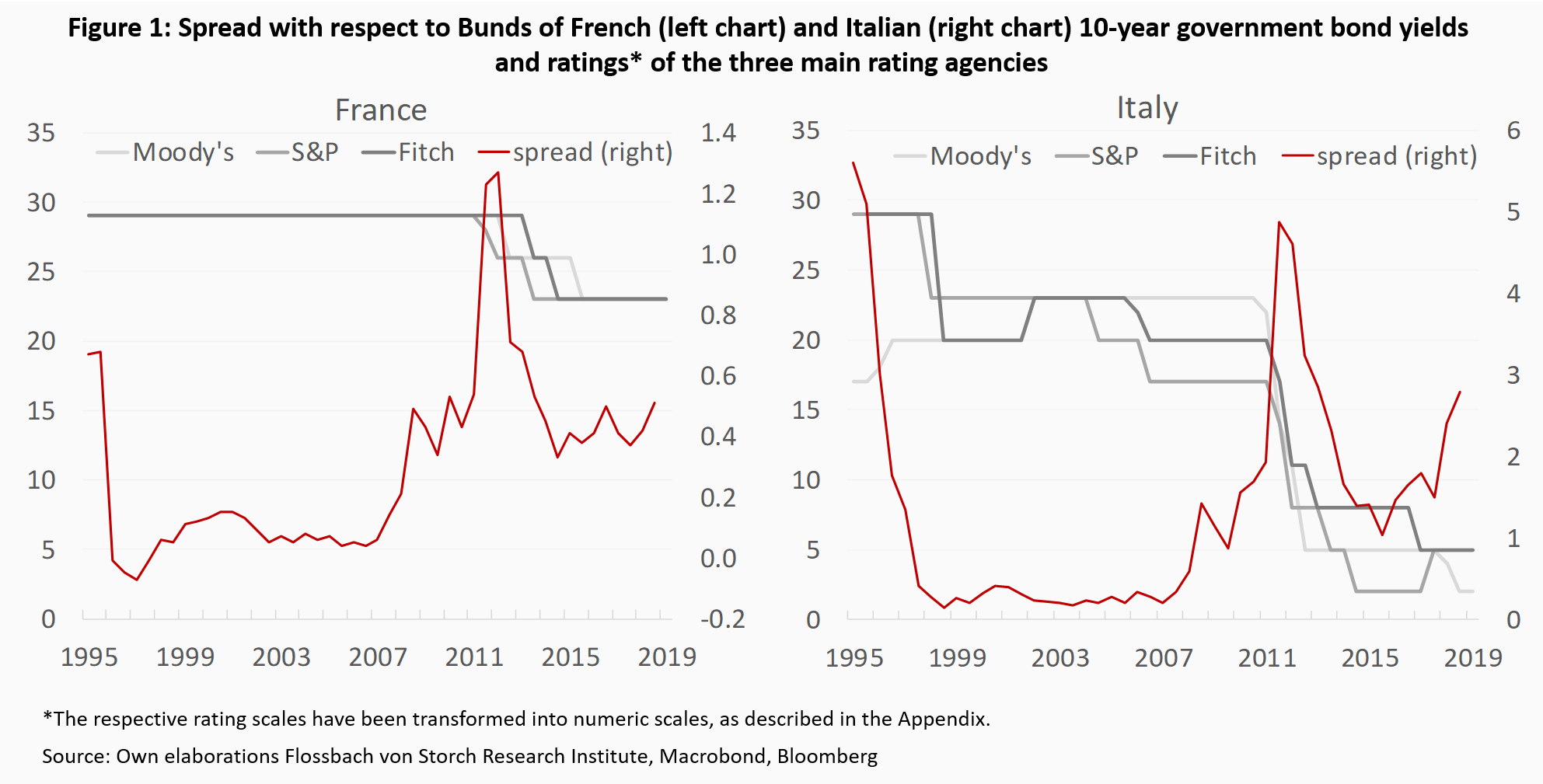

During the European sovereign debt crisis, market participants reacted to the evident worsening of public finances within the euro area by repricing debt securities of the involved countries. The spread with respect to Bunds of French and Italian 10-year government bond yields widened between 2011 and mid-2012 (Fig 1). However, thanks to the explicit rescue guarantee for the euro, sealed by the ECB President in June 2012, it then fell back to almost pre-crisis levels.

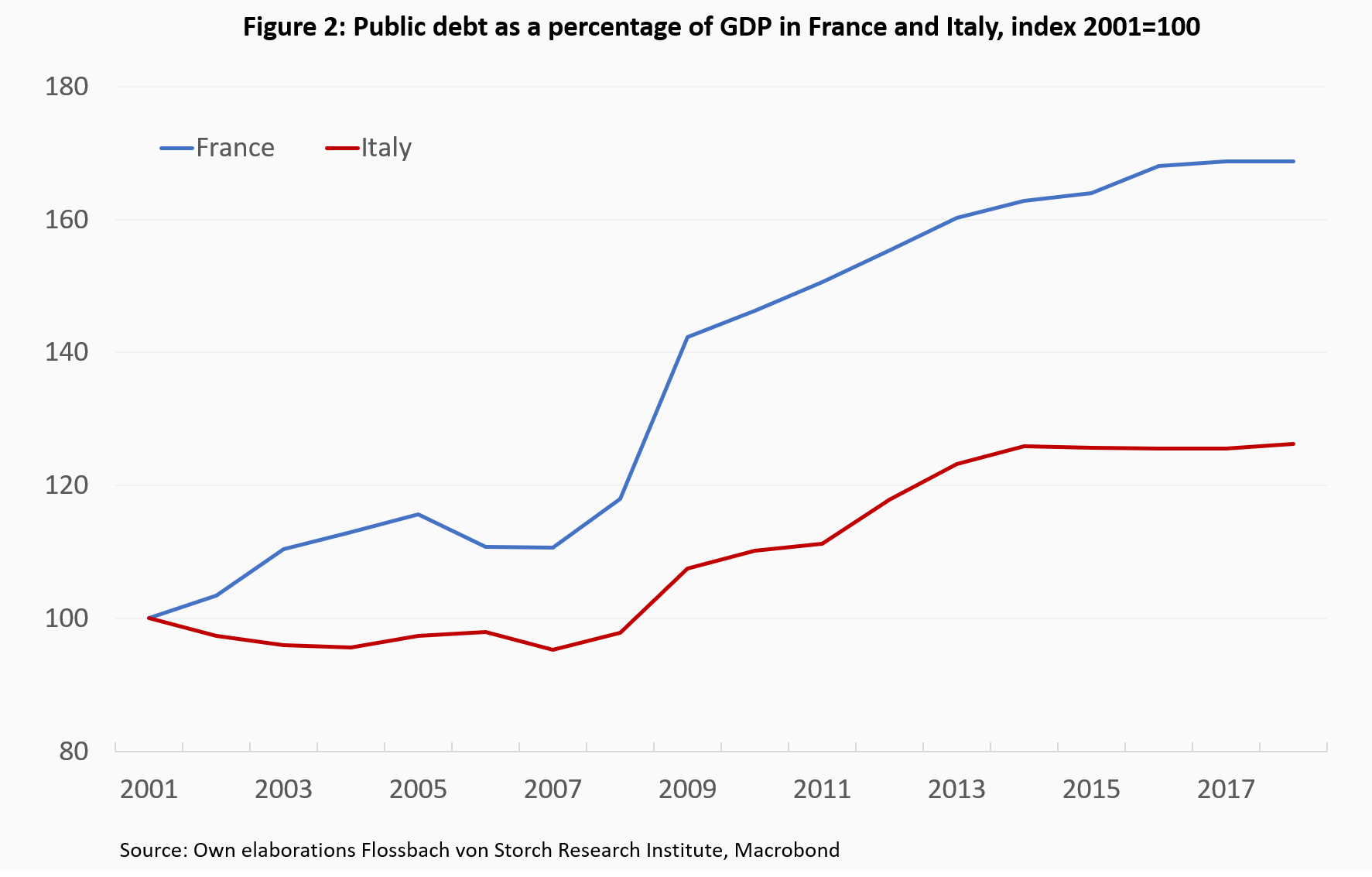

Rating agencies also reacted to the crisis by downgrading both Italy and France (Fig. 1). However, whereas the Italian rating was cut by an average of four grades between mid-2011 and mid-2014, the French rating diminished by only two grades and has remained unchanged since. This happened despite a much faster increase of public debt in France, as compared to Italy (Fig. 2).

The more benign assessment of French with respect to Italian creditworthiness is due to a stronger overall economic performance and thus an implicit expectation that rising debt would be repaid in the future.

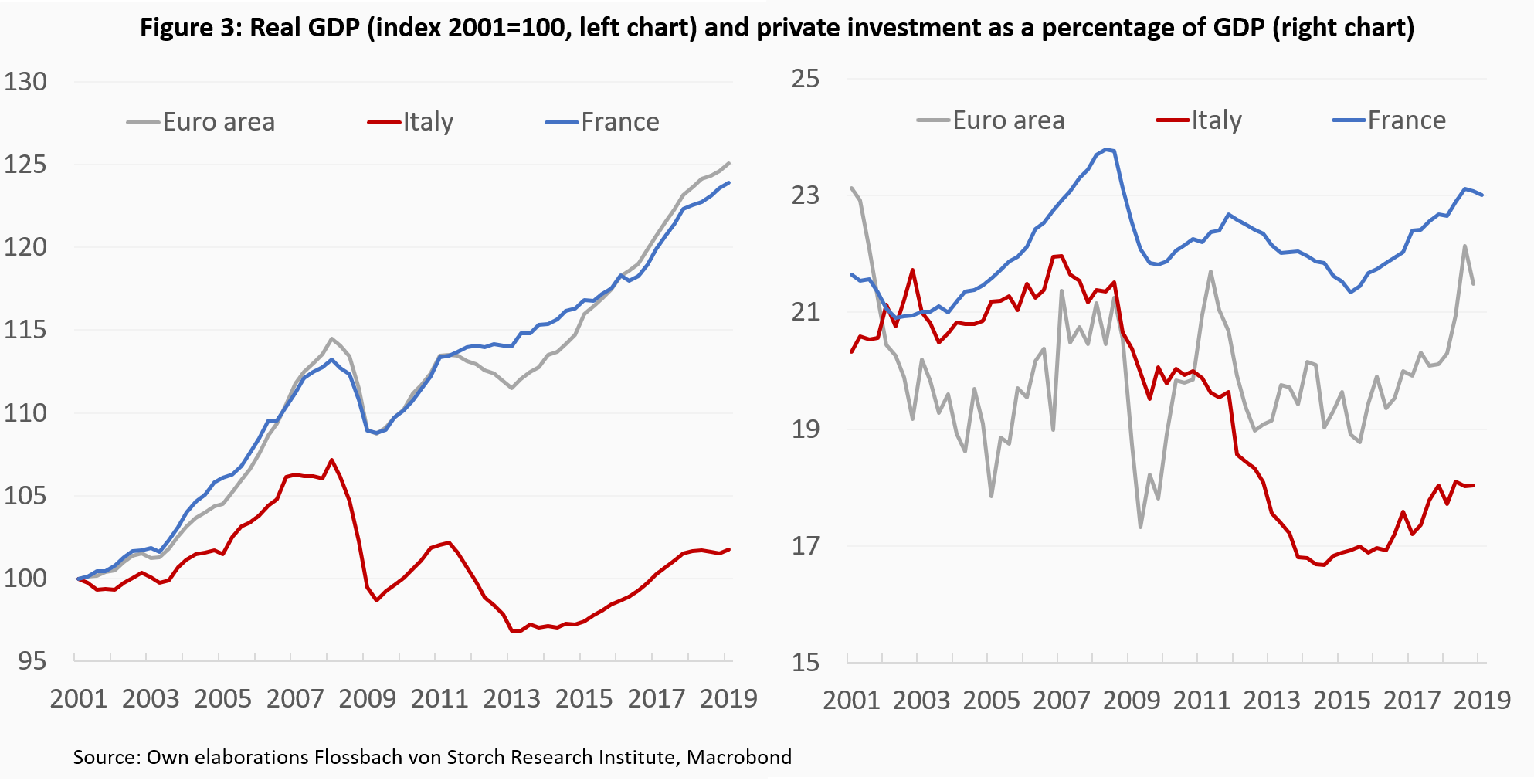

Since the launch of the euro, the French economy has grown by 24%, almost in line with the euro area average. Italy has already entered the euro area with below-average GDP growth and has been locked in stagnant growth environment, which deteriorated further after the Great Financial Crisis. France has also outperformed Italy by a large margin in terms of private investment (Fig. 3).

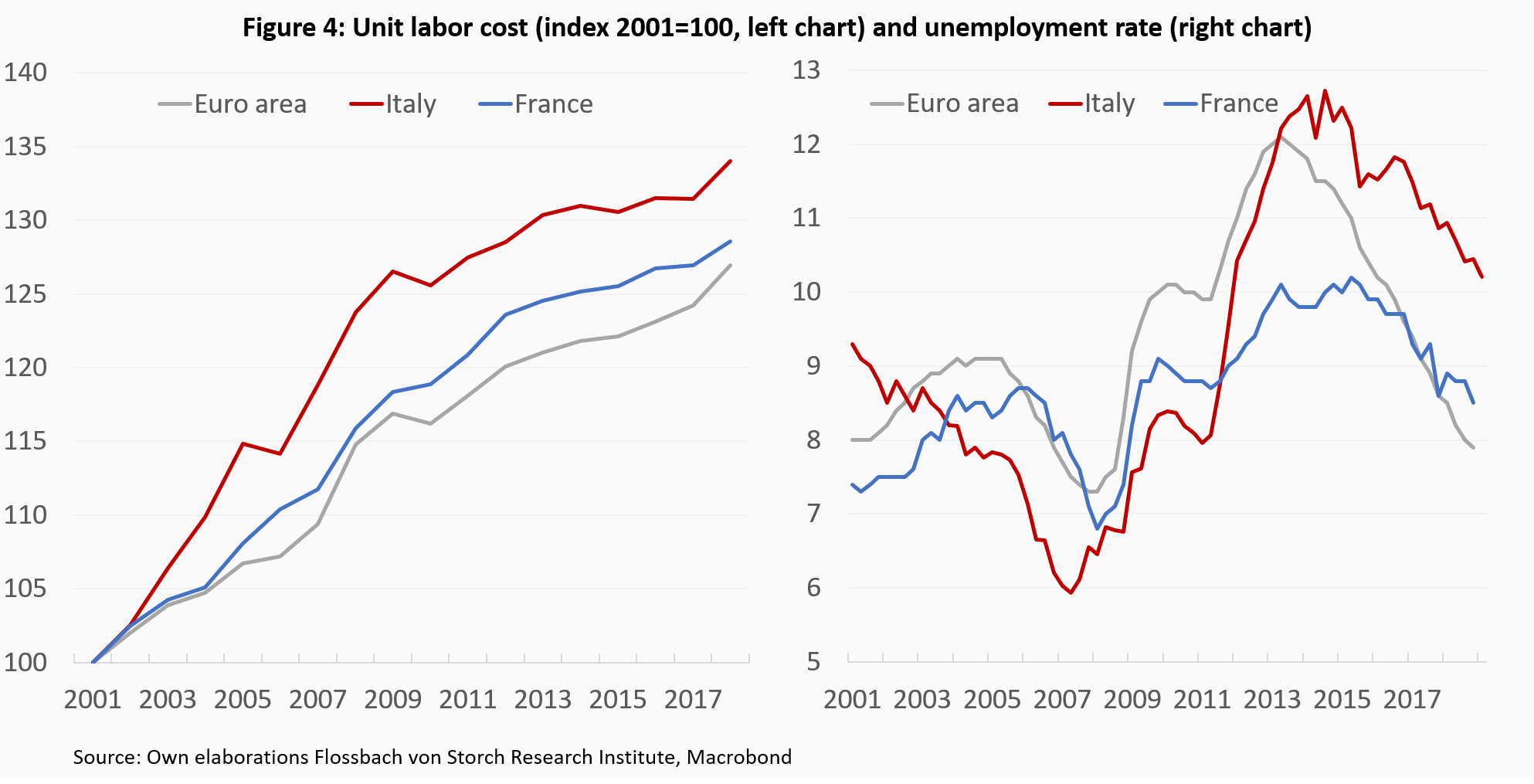

However, this relatively solid economic performance was accompanied by declining competitiveness of the French productive system. This is evident in an above-average (compared to the euro area) development of unit labor cost and a laggard recovery of the unemployment rate in the post-crisis period (Fig. 4).

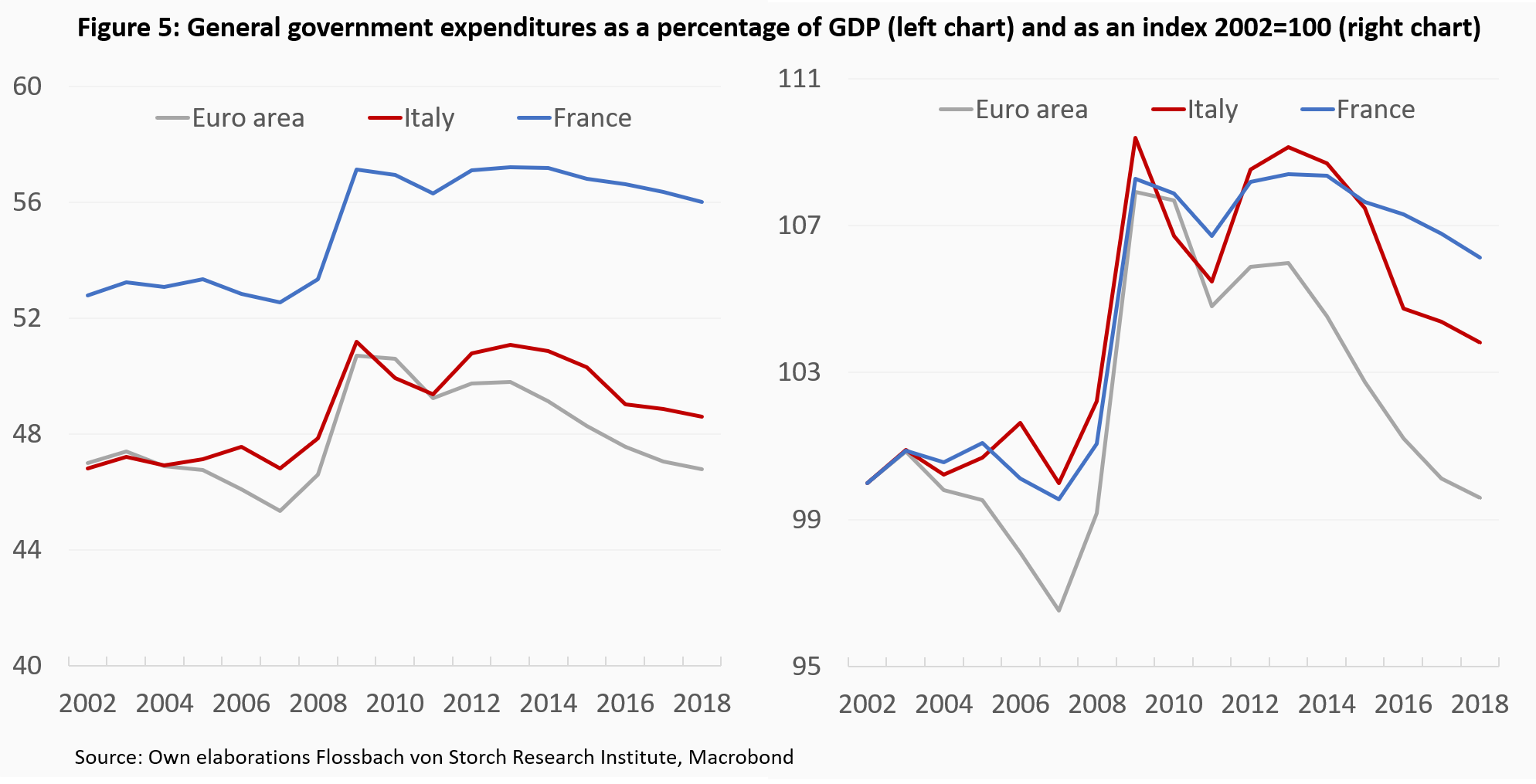

But probably the most worrying development regards general government expenditures. France has historically very high public expenditures as a percentage of GDP, compared to Italy, to the average of the euro area and to other developed economies (Fig. 5). Although some effort to diminish the size of the public sector in the more recent years is visible, this was not enough to contain the increase in the public debt.1

After the elections in 2017, President Macron launched an ambitious reform program aimed primarily at addressing structural challenges of the labor market. He managed to pass important labor market and tax reforms, which could indeed make the labor market more flexible. But amid protests, initially led by trade unions and then transformed into a nation- and content-wide opposition movement of the gilets jaunes, the government reacted with concessions, including an increase in the minimum wage and cutting taxes.

However, these measures had only a marginal effect to help the Macron’s party, La République En Marche! (REM), regaining the smelting support. As a result, Macron’s economic policy has been de facto deselected in the European elections, although by a small margin. This puts the Macron’s domestic reform into question.

This uncertain outlook for reforms adds to the issue of excessive public deficit, which is expected to return above 3% in 2019. Moreover, a permanent nature of some fiscal measures will make it difficult to bring the deficit back below 3% soon. This should keep public debt on an upward trend, making market participants’ demand for higher risk premia increasingly likely.

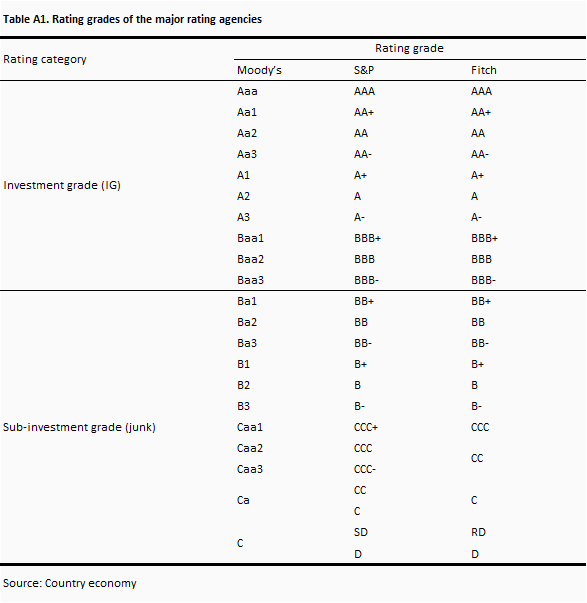

To obtain a numeric rating scale, the rating grades, as shown in Table A1, were assigned scores from 1 (the lowest grade) to 29 (the highest grade). In the process, also the outlook – positive, stable and negative – published together with ratings, was considered and assigned a numeric value. For the highest rating (Aaa/AAA), the outlook can be either stable or negative.

1 In line with high public expenditures, France breached the EU 3% deficit rule for eight consecutive years between 2008 and 2016. As a result, the country was subject to an excessive deficit procedure between April 2009 and June 2018, but the deadlines for the correction of the excessive deficit were extended three times, based on “continued weak economic conditions”, so that France has always escaped sanctions.

21.03.2019 - Companies