06.12.2018 - Comments

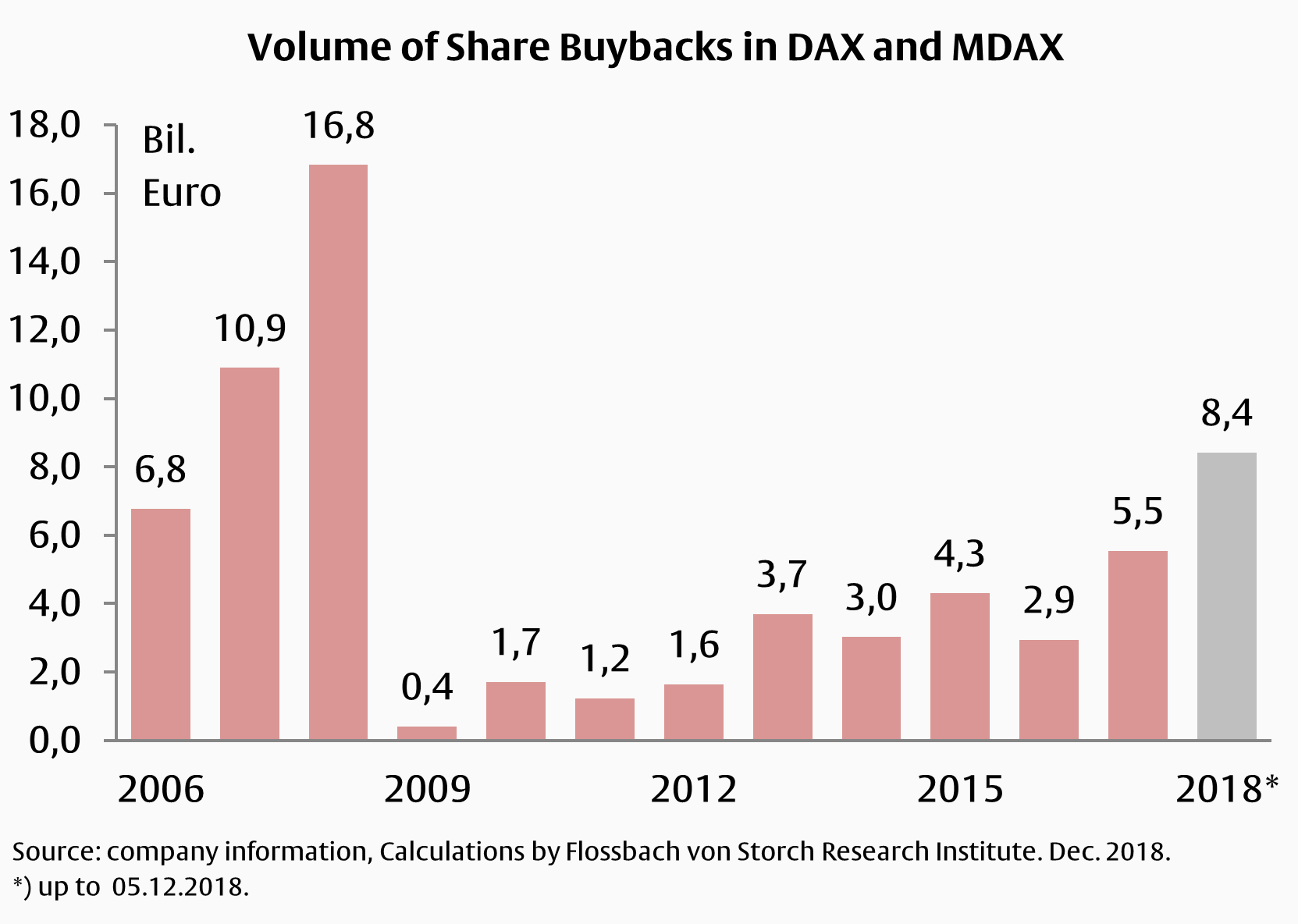

The buyback fever is spreading! At the end of 2018, the volume of share buybacks by DAX and MDAX companies exceeded the eight billion Euro mark and amounted to 8.4 billion Euros at the beginning of December.

Nine companies were active in 2018, above all Allianz, which invested as much as three billion euros in its own shares. Siemens has the second-highest volume with around 1.5 billion euros, followed by Covestro with just under 1.4 billion euros. Adidas has also been extensively active, spending one billion euros on buybacks and announcing a further two billion euros.

The previous year's volume of EUR 5.5 billion seems quite modest compared with the latest figure, although this figure already represents the highest volume since 2009.

Why did the German companies increasingly resort to share buybacks this year? To answer this question, you have to take a closer look at the capital allocation of companies.

A decision for share repurchases is at the same time a decision against investments, against a higher dividend, against the repayment of loans and against increased cash holdings. It is therefore desirable from an investor's point of view if management only decides to repurchase shares once all other options have been exhausted.

The decision to buy back shares is plausible in the case of Adidas. 2018 is a record year for Adidas. Already at the end of the third quarter, profit and operating cash flow were significantly higher than in the prior-year quarter. At the same time, investments were made in the operating business and the balance sheet also makes a solid impression. This enables Adidas to use part of the funds raised during the year directly for share buybacks. In addition, the volume can be flexibly adjusted to operating income. A special dividend would not offer management this flexibility.

However, despite all the joy, one should not forget the pro-cyclical course of share buybacks. Companies can only buy their own shares if they have sufficient excess liquidity. This is usually the case when business is going well. The capital market quickly gets wind of good business and lets the share price rise accordingly. Therefore, the prerequisites for share buybacks are usually only met if the prices are also high. This leaves companies with no choice but to buy their own shares at high prices.

The historical volume of share buybacks in Germany shows that this does not always go well. So far in 2008, the largest volume of share buybacks has been carried out at top prices. A little later, the crisis set in and prices fell. With 8.4 billion euros in 2018, the volume is now only half that of 2008, but for the last 10 years it represents the record value.

For companies and investors, it remains to be hoped that no imminent recession will follow and that the money from the buybacks will not soon be missing elsewhere.