17.02.2020 - Comments

The influence of the coronavirus on the Chinese economy cannot be denied. The curfews and travel restrictions imposed by the central government prevent workers and companies from returning to work. The Shanghai Composite lost as much as eleven percent in the meantime. The influence was also evident on the German stock market; after all, major German corporations maintain large business operations in China. The DAX was down about three percent in the meantime.

Is this given the economic losses a rational market reaction or do markets let themselves be carried away by the narrative of an unforeseeable epidemic?

Let's run a simple model calculation.

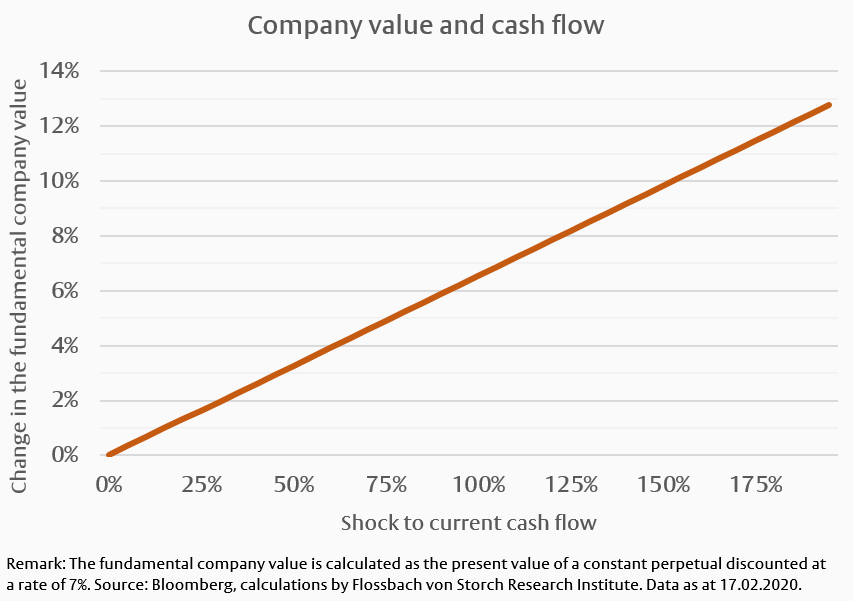

Let's assume that due to the epidemic, a company's cash flow is zero in the first two quarters of the current year. Business does not return to normal until the third quarter. Subsequently, the company generates a perpetual constant cash flow, which is discounted at seven percent, as appropriate for large corporations.

By how much is the affected company worth less than a company that has not suffered any losses from the coronavirus? In fact, the difference is only three percent. Even if the cash flow of the affected company was zero in 2020, the value would only be around six and a half percent below the reference value.

To obtain a price decline of eleven percent, as reflected in the Chinese stock market, the cash flow for 2020 would not only have to be fully depleted, but a loss for the entire year of 70 percent of the perpetual cash flow would have to be incurred. The interim drop in the DAX of around three percent corresponds to a short-term cash flow shock of 45 percent. Both figures seem unrealistic in view of the length of viral epidemics such as SARS, MERS and H1N1.

It is therefore reasonable to assume that the price reaction on the Chinese and German stock markets was not only characterized by uncertainty, but also by the exaggeration of the matter. The value of a company consists to a great extent of the cash flows that will be earned in the coming years. An effect that only affects two, but perhaps three quarters and may even be reversed, should not cause a long-term investor to worry.

With the announcement of declining new infections, the stock markets also seem to have overcome the narrative. In mid-February, the DAX was already two and a half percent higher than a month earlier. Prices on the Chinese stock exchange are also on the road to recovery and are now only three and a half percent lower.

A long-term oriented investor, on the other hand, could was pleased in the meantime about the favourable investment opportunities.

Legal notice

The information contained and opinions expressed in this document reflect the views of the author at the time of publication and are subject to change without prior notice. Forward-looking statements reflect the judgement and future expectations of the author. The opinions and expectations found in this document may differ from estimations found in other documents of Flossbach von Storch SE. The above information is provided for informational purposes only and without any obligation, whether contractual or otherwise. This document does not constitute an offer to sell, purchase or subscribe to securities or other assets. The information and estimates contained herein do not constitute investment advice or any other form of recommendation. All information has been compiled with care. However, no guarantee is given as to the accuracy and completeness of information and no liability is accepted. Past performance is not a reliable indicator of future performance. All authorial rights and other rights, titles and claims (including copyrights, brands, patents, intellectual property rights and other rights) to, for and from all the information in this publication are subject, without restriction, to the applicable provisions and property rights of the registered owners. You do not acquire any rights to the contents. Copyright for contents created and published by Flossbach von Storch SE remains solely with Flossbach von Storch SE. Such content may not be reproduced or used in full or in part without the written approval of Flossbach von Storch SE.

Reprinting or making the content publicly available – in particular by including it in third-party websites – together with reproduction on data storage devices of any kind requires the prior written consent of Flossbach von Storch SE.

© 2024 Flossbach von Storch. All rights reserved.